Updated: 7/11/2019 2:02:51 PM

In 2018, the world economy maintained a recovery, and China's economy remained stable, creating a relatively favorable market environment for China's chemical fiber industry, supporting the industry to achieve smooth operation. Aside from the fourth quarter, the overall performance of China's chemical fiber industry in 2018 maintained good growth, and the growth rate of efficiency was stable in a higher range, which became an important support for the economic growth of the textile industry. However, the operation of each sub-sector has been different. The overall performance of the polyester fiber and polyamide fiber industries were good, while the viscose fiber, acrylic fiber, polyurethane fiber industries had difficult year.

I. Basic Situation of Industry Operation

(A) Production

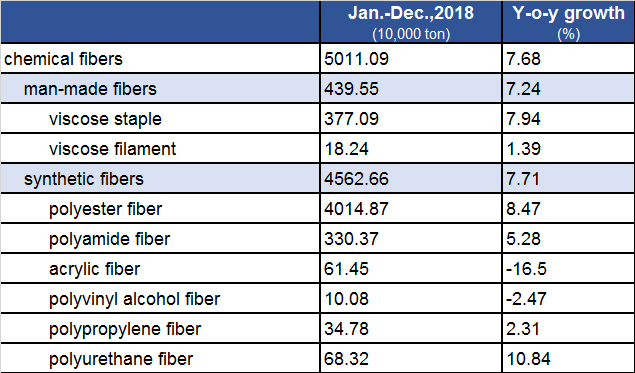

According to the National Bureau of Statistics, in 2018, the production of chemical fibers was about 50.11 million tons, seeing year-on-year rises of 7.68%. Among them, the polyester fiber production was about 40.14 million tons, with year-on-year growth of 8.47%; the polyamide fiber production was about 3.3 million tons, growing by 5.28% year-on-year; while viscose staple production was about 3.77 million tons, edged up 7.94% year-on-year.

Since the chemical fiber industry entered the "new normal" in 2012, the output growth rate has slowed down and the backward production capacity has been accelerated. After entering the 13th "Five-year Plan" period(2016-2020), China's chemical fiber industry continued to promote the supply-side structural reform, eliminating backward production capacity. From 2012 to 2018, the annual growth of chemical fiber production was 4.55%, and the growth rate was less than one-half of the peak year of production growth.

Table 1: Chemical Fiber Production in 2018

Source: National Bureau of Statistics, China Chemical Fibers Association

The production and sales of the polyester fiber and polyamide fiber industries thrived, and the average operating rate of the chemical fiber industry was at a relatively high level in the past two years. Among them, the operating rate of the polyester filament industry remained high, which reached over 90% in the peak season and remained above 80% in the off-season. Due to the release of a large number of new capacities, the polyurethane fiber industry saw a large increase in output year-on-year. The operating rate of the viscose fiber industry and the acrylic fiber industry was significantly lower than that of 2017, which were the relatively low level in the past two years.

(B) Import and Export

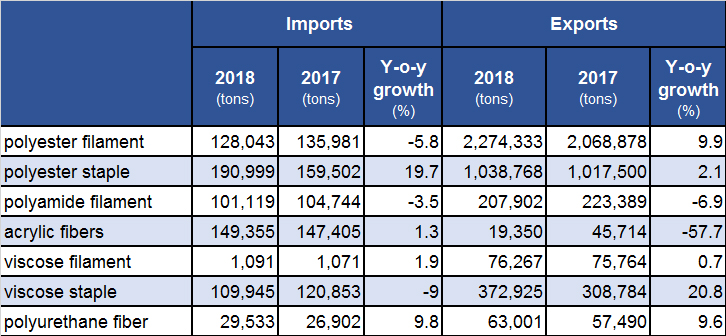

Due to data source problems, there is no accurate import and export data for the chemical fiber industry. According to the calculation of the China Chemical Fibers Association, the import volume of chemical fiber in 2018 was about 940,000 tons, up about 2% year-on-year. Thereinto, the imports of polyester staple saw year-on-year growth of nearly 20%, which should be related to the limitation of domestic regenerated raw materials, so as to make up for the shortage of recycled fiber production. It was understood that a considerable part of the increase in the import was because of regenerated polyester staple.

The export volume of chemical fiber was about 4.3 million tons, seeing about 6% of growth. The impact of Sino-US trade friction has not yet fully manifested, and the export volume of the three major products, i.e., polyester filament, polyester staple and viscose staple has maintained a good growth rate.

Table 2: Import and Export of Chemical Fiber Products in 2018

(C) Market

Due to fluctuations in oil prices, the price of synthetic fibers market was generally higher than that of 2017. In particular, the polyester fiber industry has experienced ups and downs in the second half of the year. Affected by the suppression of cotton prices and the release of new capacity, the viscose staple market was generally in a weak consolidation.

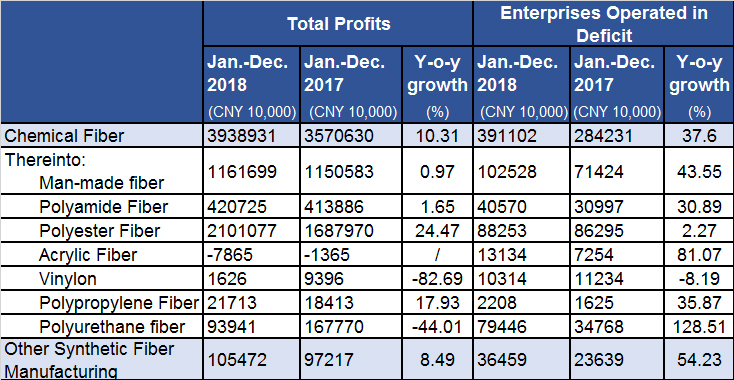

(D) Quality and Efficiency

In 2018, the industrial added value of China's chemical fiber industry increased by 7.6% year-on-year, 1.8 percentage points faster than that of 2017; the main business income was CNY 798.95 billion, up 12.42% year-on-year; the total profit was CNY 39.38 billion, increased by 10.31% year-on-year. The chemical fiber industry has become an important support for the economic growth of the textile industry. 18.23% of chemical fiber enterprises operated in deficit, increased 5.21 percentage points year-on-year; the loss value of these enterprises surged sharply by 37.6% year-on-year, reflecting the continued polarization of corporate profitability.

Table 3: Economic Benefits of Chemical Fiber Industry in 2018

Source: National Bureau of Statistics

Judged from the operation quality of the chemical fiber industry, the profitability of the industry decreased slightly than that of 2017. The profit margin of the main business reached 4.93%, down 0.09 percentage points year-on-year; total assets turnover was same with that of 2017, while the finished goods turnover dropped; marketing cost and financial cost of the share of three overheads in turnover declined slightly. The increase in industry profits seemed like the results of the increase in product prices and the downstream demand, however, its essence was that the supply-side structural reform has achieved certain results, and the new product development was accelerating in terms of brand, quality, and variety.

II. Operation Forecast of the Chemical Fiber Industry in 2019

(A) Industry Operation Background

Although the global economy will continue to expand in 2019, the risks it will faced are rising, and the growth momentum will be weakened. China's economic operation is also facing downward pressure. It is expected that China's economy will continue to maintain steady growth, while its growth rate may fall slightly from 2018.

Under pressure, it is expected that the growth rate of the main operating indicators of the textile industry will fall back from 2018, and the pressure of export growth is particularly prominent. The inherent needs of the textile industry to promote high-quality development are more urgent. Only improve production efficiency and risk resistance can maintain stable development.

(B) Operation Forecast of Chemical Fiber Industry

In 2019, the chemical fiber industry, especially the polyester fiber industry, is still at the peak of production. The supply is increasing while the demand is not optimistic, which makes the contradiction between supply and demand in the market will gradually become prominent.

It is estimated that in 2019, the average operating rate of the chemical fiber industry will decrease than that of 2018, and the output will continue to maintain the growth rate of around 5% in recent years; the export volume will increase slightly; and the economic benefits are weaker than 2018. The gap in corporate competitiveness has further widened, and the flagship effect and subdivision effect are emerging.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor :China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS